Business

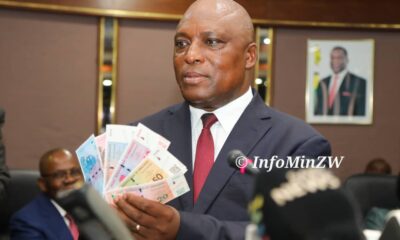

Will new John tame Zim inflation?

Dr Mushayavanhu will present his maiden Monetary Policy Statement (MPS) amid a tough operating economic environment due to the sustained depreciation of the Zimbabwe dollar.

A HERCULIAN task today awaits the recently appointed Reserve Bank of Zimbabwe (RBZ) Governor Dr John Mushayavanhu, when he introduces new monetary policy measures aimed at stabilising the volatile domestic currency and tame rising inflation.

Dr Mushayavanhu will present his maiden Monetary Policy Statement (MPS) amid a tough operating economic environment due to the sustained depreciation of the Zimbabwe dollar.

The local currency continued to depreciate faster, both on the formal and parallel market.

According to the Confederation of Zimbabwe Industries, the domestic unit had lost more than 49 percent of its year-opening value on the formal market and 30 percent on the parallel market since January.

In a bid to restore long-lost confidence and avoid speculation in the country’s financial system Mushayavanhu yesterday publicly declared the assets held by the apex bank.

It was revealed that the RBZ has 2,6 tonnes of gold valued at US175 million and other precious minerals as well as US$300 million cash reserves.

Analyst are anticipating that the new RBZ Governor, will pronounce measures that will restore the value preservation function for the domestic currency.

During the first Cabinet meeting in February President Mnangagwa in February hinted at a structured currency.

Before his latest appointment, Mushayavanhu was group chief executive officer at First Banking Corporation (FBC) Holdings Limited, which owns FBC Bank as its subsidiary.

He is also a former president of the Bankers Association of Zimbabwe.

Business

Power Giants Africa win in Zambia

‘The Zaba celebrates excellence, inspiration and success within the Zambian business community’

By BUSINESS REPORTER

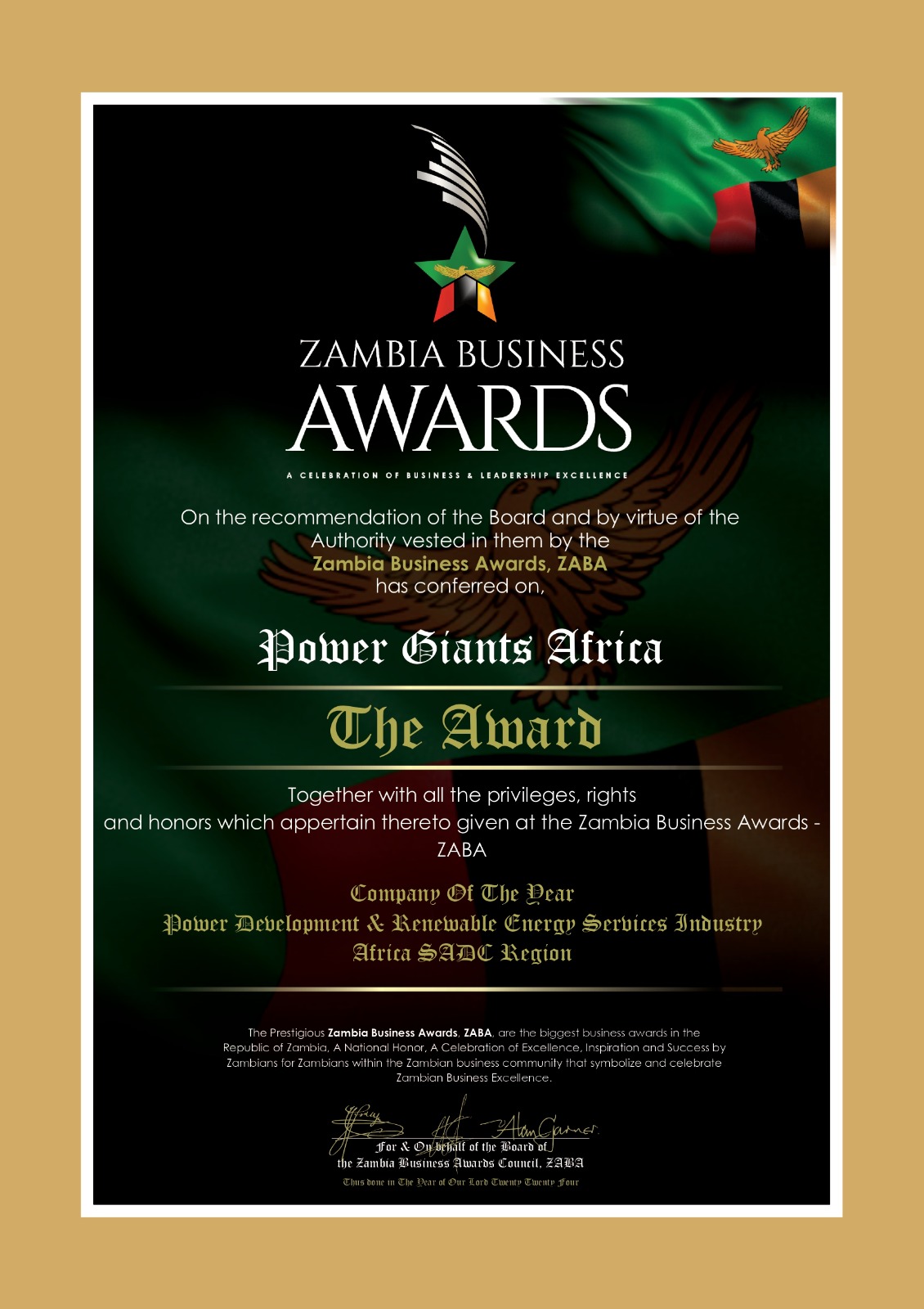

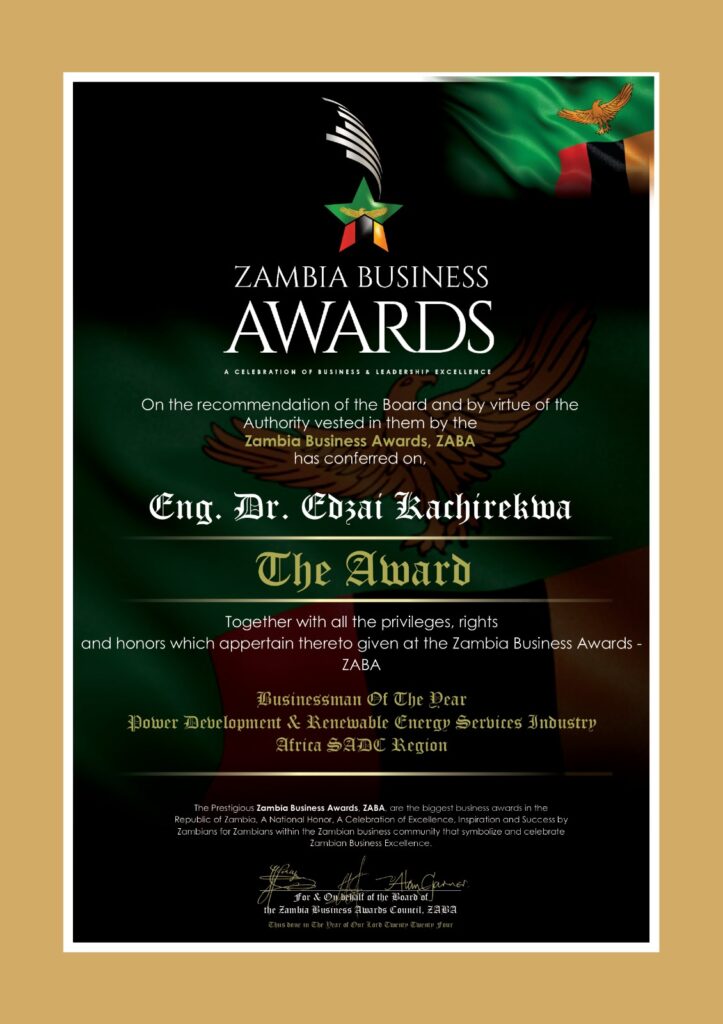

BUSINESSMAN Edzai Kachirekwa and his company Power Giants Africa continue to receive international accolades with the latest ones at the Zambia Business Awards (Zaba) held recently.

Kachirekwa, who is the founding director of Power Giants Africa, was awarded the Businessman of the Year: Power Development and Renewable Energy Services Industry Africa Sadc Region.

His company received the Company of the Year: Power Development and Renewable Energy Services Industry Africa Sadc Region award.

The Zaba celebrates excellence, inspiration and success within the Zambian business community.

Kachirekwa attributed his successes to his faith in God that has led him to pursue excellence in the industry.

“In our industry we transform the challenges that we face as a nation into opportunities. My business attitude is in line with the word of God and these are the fruit of his blessings”

“My country Zimbabwe and other African nations cannot continue to experience power and energy deficits yet we have options that we can exploit including solar energy among others.”

Power Giants is a local company that specialises in transmission power lines construction, solar systems including construction of solar grids, domestic, industrial, mining, agricultural and commercial installations.

The company recently entered into a smart energy partnership deal with GNEE China that aims to create a billion-dollar solar project to resolve Zimbabwe’s chronic power deficit.

Business

Govt, Zanu PF issues Icarus-fate warning to motormouth Wicknell Chivayo

ASPIRING billionaire Wicknell Chivayo appears to have dug his own grave, less than a month after his company was awarded a lucrative Starlink deal to be the sole provider of in Zimbabwe

Reacting to a viral audio leaked recently were Chivayo bragged that the President was under his wings, government and Zanu PF spokespersons have issued a veiled warning to Chivayo against flying too close to the sun, by abusing his proximity to President Emmerson Mnangagwa.

In separate posts on X Nick Mangwana and Farai Marapira said Chivayo was forgetting that he was a nonentity in the political matrix of this country.

Mangwana said like Icarus Chivayo was flying too close to the sun, had quickly forgotten that his wings were made from wax which would easily melt.

“Icarus was warned by his father not to fly too close to the sun, as the wax that his wings were made from would melt. But fueled by the adrenaline rush of flying , Icarus failed to rein in his excitement and felt he was the man of the moment. He did not heed the warnings, Icarus was so intoxicated by the experience of flying and never thought he could tumble from this loft height, so he flew higher and higher getting closer and closer to the sun. The closer he came to the sun, the more the wax in his wings melted. He tumbled into the sea and drowned,” said Mangwana.

Zanu PF spokesperson Farai Muroiwa Marapira weighed in saying pride comes before a fall.

Breaking News

Dubai traffic management investor to inject over USD60 mln

“The installation of the Smart Traffic Management System will benefit Zimbabwe in a number of ways including the following: enforcement of the law by bringing to book all traffic regulation violators’

A DUBAI-BASED company that specialises in Smart Traffic Management Systems (STMS), Vitronic Machine Vision Middle East, will initially invest between US$60 to 80 million in installation of the Smart Traffic Management System

Cabinet has approved the engagement of Vitronic Machine Vision Middle East in implementing an SMTS in Zimbabwe following a report presented by Home Affairs and Cultural Heritage minister Kazembe Kazembe.

The company visited the country recently to carry out a feasibility study and engage key stakeholders.

The project will be implemented under a Public-Private-Partnership model and will, at inception, be implemented in Harare and Bulawayo Metropolitan provinces.

“The installation of the Smart Traffic Management System will benefit Zimbabwe in a number of ways including the following: enforcement of the law by bringing to book all traffic regulation violators; reduction of road carnage; reduction of traffic congestion in the Central Business District; reduction in corruption as there will be minimal human intervention; improved revenue streams for Government which will be used to improve policing; and improved national security as intelligent cameras will be installed and linked to the database of stolen vehicles and wanted criminals,” reads part of Kazembe’s report.

The company will recover its investment from fines paid for traffic violations through a revenue sharing arrangement.

The company has installed similar systems in a number of countries including Morocco, Rwanda, United Arab Emirates, Saudi Arabia, France, Germany and Belarus.

-

Tourism1 year ago

Tourism1 year agoAntelope Park joins White Rhino fight

-

Breaking News10 months ago

Breaking News10 months agoZim Community Trailblazers Awards (ZCTA) Call for Entries (5th Edition)

-

Health and Wellness1 year ago

Health and Wellness1 year agoLeaked nudes: Traumatic impact, healing pathways

-

Entertainment4 years ago

Entertainment4 years agoCharambas ZCTA maiden winners

-

Breaking News12 months ago

Breaking News12 months agoMnangagwa approves Starlink Zim operations

-

Entertainment1 year ago

Entertainment1 year agoSetina Mandiveyi plots to shine

-

Tourism1 year ago

Tourism1 year agoWhite Rhino grazing at Zim’s biggest private game reserve

-

Zim Community Trailblazers Awards1 year ago

Zim Community Trailblazers Awards1 year agoDr Peta: First Zim to obtain Disability Studies PhD